Battle of The Search Engines – Google vs. Bing vs. Yahoo

July 25, 2012

San Diego Non-Profit Keeping Californians Secure

July 30, 2012High speed bandwidth has given select firms on Wall Street a competitive edge when it comes to online trading.

High-Speed Bandwidth

Data centers are constantly increasing their bandwidth with superior hardware with new facilities closer to Wall street. Industry insiders may argue. High-speed internet may be an unfair advantage to businesses with the fastest bandwidth connection. Faster bandwidth can connect a financial data center to a major financial hub in New York & New Jersey via low-latency fiber routes. These high-speed connections can shave fractions of a second of the time it takes to place a trade, affecting it’s profitability. These so-called low latency connections are said to execute trades nanoseconds.

The ability for a company to execute high speed trades may be good news for those looking to gain a competitive edge. Though market regulators from around the world are worried. As the trend of high-speed trading spreads, so will the risk of radical market shifts. High speed techniques are used by banks and hedge funds on Wall Street, while the practice with smaller firms dates back only 10 years. In 2009 the SEC noticed profit margins of such companies increased drastically, while millions of shares were bought and sold in a matter of minutes. It was around that time that regulators began to wonder if high speed trading was in fact, detrimental to the world trading landscape

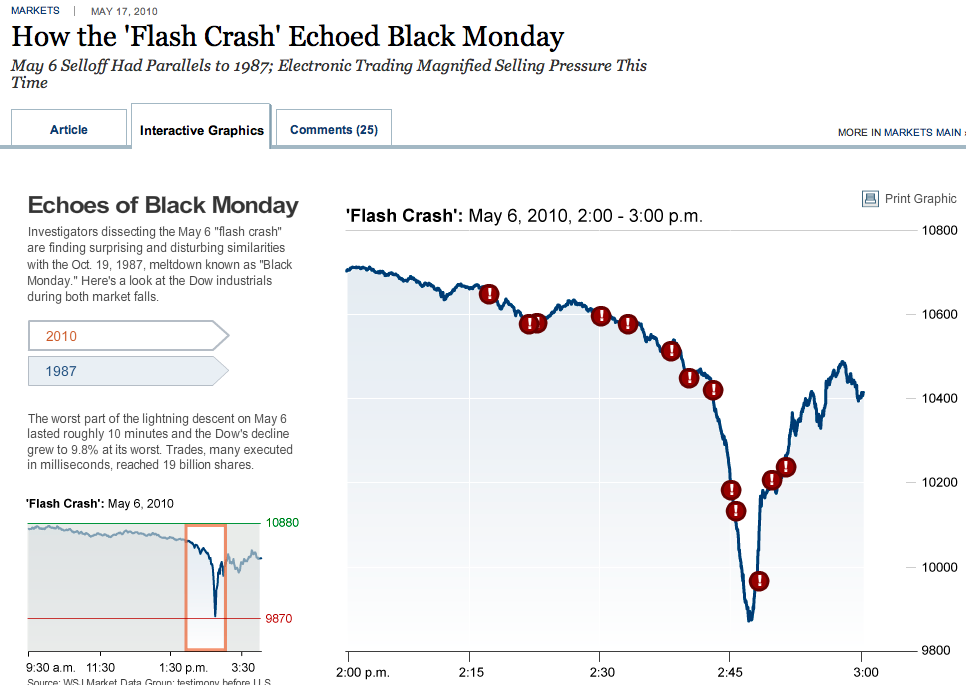

The Flash Crash of May 6, 2010

A drastic swing in stock behavior unfolded on May 6, 2010 when stocks plummeted 700 points in a matter of minutes before they recovered. High-speed trading was not blamed, though regulators speculate trades that were suddenly cut off caused the erratic spike in the market.

Bandwidth Not to Blame

Though bandwidth narrowly escaped public scrutiny during the Flash Crash of 2010, it is still a questionable subject amongst Market Regulators. An optimized network between markets has made trading even faster and possibly more predictable today. To fend of regulators, firms have hired their own industry trade group staff in hopes of legitimizing high speed trading techniques.